How First Time Home Buyer Incentive Bc can Save You Time, Stress, and Money.

Table of ContentsFirst Time Home Buyer Incentive Bc Things To Know Before You Get ThisFirst Time Home Buyer Incentive Bc Things To Know Before You BuyFascination About First Time Home Buyer Incentive BcThe 15-Second Trick For First Time Home Buyer Incentive Bc

00:00:38 which is why the incentive is registered as a bank loan on the building. Aesthetic: The video reduces to a split-screen shot. On the left 2 thirds, a couple and their little one are sitting close with each other at a table having fun with a game and, on the best third, an upright yellow band appears with the complying with text composed in purple: "motivation is registered as a bank loan on the property" 00:00:43 There are, nonetheless, Visual: The text in the yellow band on the right 3rd on the screen is changed with the following: "no routine primary settlements no rate of interest optimum term of 25 years" 00:00:44 no routine major repayments, 00:00:45 it births no interest, 00:00:47 as well as it has a maximum term of 25 years.ca" 00:01:40 To learn exactly how to use, 00:01:41 check out the last video clip in this four-part series. Aesthetic: Against the yellow history, the adhering to message shows up: "Have a look at the last video clip in the collection" Listed below it, there is a white line drawing of a residence with bushes as well as a tree - first time home buyer incentive bc.

The shot after that reduces to a full-screen white background. Versus it are the yellow, purple and grey National Real estate Method logo, on the left, and also the Canada Wordmark, on the.

Little Known Facts About First Time Home Buyer Incentive Bc.

When real estate rates rose into the air, deposits are dragged along for the ride developing a headache for first-time residence customers (first time home buyer incentive bc). Possible customers may stretch a dollar, conserve as well as compromise their means to a minimum down settlement just to discover that the staying home mortgage quantity more than loan providers intend to accept.

, indicating you have never possessed a house. Property owners that have actually gone through a divorce or breakdown of a common-law collaboration are also qualified, as are those that have not lived in a residence that they owned (or that was had by their spouse or common-law companion) for the last 4 years.

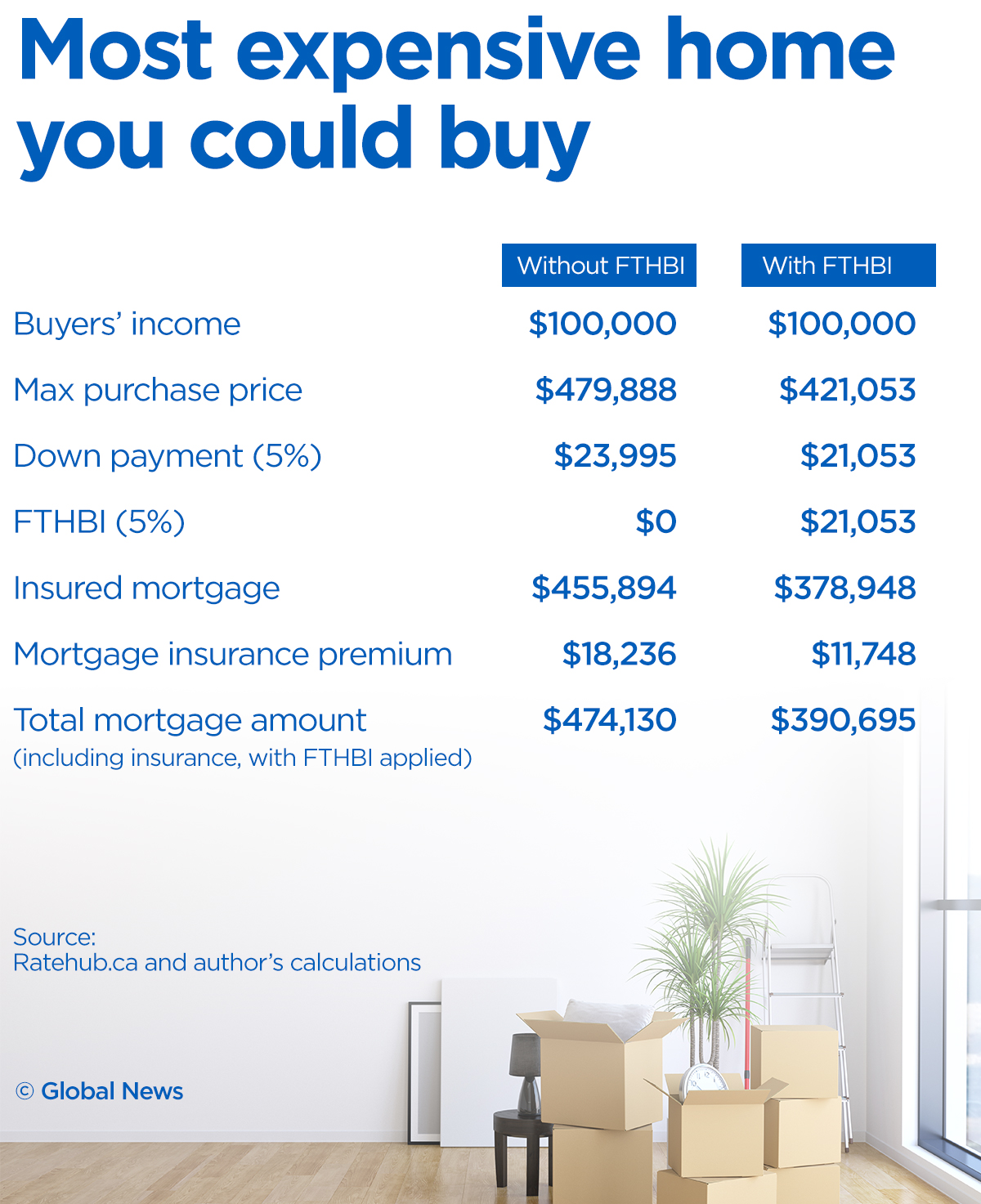

Be pre-approved for a mortgage that is extra than 80% of the home's worth, and therefore covered by home mortgage insurance policy. Compare Canada's top mortgage loan providers and also brokers side-by-side and figure out the ideal mortgage rates that will certainly satisfy your demand Eligible home customers can look for the FTHBI once they have actually been pre-approved for a home mortgage by a home mortgage lender as well as located your house they wish to purchase.

In Toronto, Vancouver as well as Victoria, the limit is 4. 5 times your earnings. Your overall family revenue can't be more than $120,000. In Toronto, Vancouver as visit this site right here well as Victoria, the cutoff is $150,000. Allow's state you live in Ottawa and your home makes $120,000. Under the regards to the Incentive program, the home mortgage can not be even more than 4 times your income.

What Does First Time Home Buyer Incentive Bc Mean?

If you reside in Vancouver and also make the family max of $150,000, one of the most you might borrow from a home loan loan provider and still be approved for the FTHBI program is $675,000. If your house makes even a buck a lot more than those earnings limits, or there are no homes for sale within the rate limitations developed by the government, your application for a FTHBI loan will not be approved.

Because you've gotten in into a shared equity agreement with the federal government, they essentially have 5% or 10% of your home. When that residence gets marketed, hopefully for even more than you originally paid, they're qualified my latest blog post to remove the same percentage of equity, however it's based upon the existing market price rather than the initial purchase.

Let's state you locate a $500,000 apartment in Vancouver, as well as you take out a FTHBI loan of 5% of the acquisition cost, or $25,000. When you determine to market the home 10 years later, it's worth $800,000. At the time of sale, you'll owe the FTHI program 5% of the sale price not the $25,000 you initially borrowed, but $40,000 (first time home buyer incentive bc).

Paying back much more than what you borrow is bound to sound undecided to some people, yet the program isn't intended to aid resident optimize their profits. It's concerning obtaining new customers into a residence when there are couple of various other alternatives. The FTHBI is really a bank loan on your building, and home loans aren't complimentary.

The Greatest Guide To First Time Home Buyer Incentive Bc

You can repay it at any kind of time you like, without selling your house and scot-free. Your settlement will be based upon 5% or 10% of the house's worth at the time, as determined by a professional evaluator Beginning a home acquisition with a larger deposit means obtaining a smaller sized home mortgage, which need to bring about less interest fees and also smaller monthly payments.

By lowering the cost of your home mortgage, the FTHBI might obtain you into a home when nothing else program can. Certain, you could need to repay greater than you borrowed, but assume about the equity the FTHBI car loan can aid you collect in the meantime. If your property increases in worth, you'll have to repay twice what you obtained, however why not look here those 10s of countless dollars will be settled out of hundreds of countless bucks in profit revenue you would not have actually earned without the FTHBI.

You can repay the finance in full at any moment prior to the 25-year home window shuts, offering you an opportunity to exit the program prior to your house has time to value at also torrid a pace. The income as well as residence appraisal limitations might be too low to assist lots of families locate real estate that meets their needs.